New data from a study released by Numerator reveals that anticipated tariffs are poised to significantly reshape consumer shopping behavior.

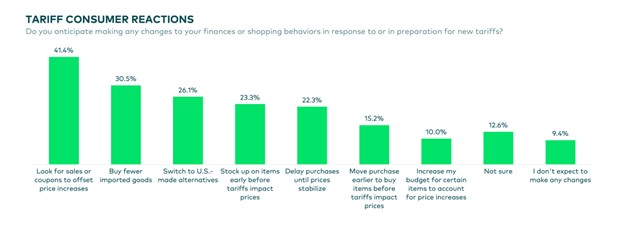

The dominant anticipated response is a heightened focus on value-seeking. 41% of consumers plan to actively search for sales, promotions, and coupons to mitigate the impact of higher prices. This suggests a potential surge in the effectiveness of discount-driven marketing campaigns and an increased importance on communicating value propositions clearly.

Beyond value-seeking, consumers are also considering altering their product choices. Nearly one-third (30%) intend to purchase fewer imported goods, while a slightly smaller, but significant, proportion (26%) plan to switch to domestically produced alternatives. This indicates a potential shift in market share towards US-made products and a need for imported goods brands to proactively address consumer concerns.

The data also suggests anticipated shifts in purchasing. Almost a quarter of consumers (23%) plan to stockpile goods before potential price increases, indicating a potential for short-term sales spikes followed by a possible lull. Conversely, 22% intend to delay purchases until prices stabilize, suggesting a need for flexible promotional strategies and inventory management.

Interestingly, a smaller segment (10%) of consumers expect to increase their budgets for specific items, acknowledging the inevitability of price increases. This represents a niche market that may be less price-sensitive but still requires potential changes in targeted messaging.

Key Consumer Behavioral Shifts:

- Increased Value-Seeking: 41% will actively search for sales and coupons.

- Shift Away from Imported Goods: 30% will buy fewer imported products.

- Preference for US-Made Alternatives: 26% will switch to domestic brands.

- Stockpiling: 23% will purchase items in advance of price increases.

- Purchase Delay: 22% will postpone purchases until prices stabilize.

- Budget Increase (Specific Items): 10% will increase budgets for certain goods.

Why this data matters:

This Numerator data underscores the critical need for marketers, brands and agencies to be agile and responsive in the face of potential tariff-driven price fluctuations. Brands must proactively address consumer concerns about rising prices and adapt their strategies accordingly. This includes:

- Prioritizing Value Communication: Clearly articulating value propositions and highlighting promotions will be paramount.

- Developing Flexible Promotional Strategies: Being prepared for both potential sales spikes (due to stockpiling) and lulls (due to purchase delays) is crucial. Dynamic pricing strategies may be necessary.

- Considering Highlighting Unique Value Propositions: Brands reliant on imported goods should highlight the unique value proposition of their imported products to justify potential price increases. Domestic brands may consider highlighting price consistency or US Made.

- Segmenting Audiences: Recognizing that different consumer segments will react differently to tariffs allows for more targeted and effective messaging. Tailoring communications to value-seekers, those prioritizing domestic goods, and those willing to increase budgets will be key.

- Monitoring consumer Sentiment: Closely monitor consumer behavior and be ready to adjust in real-time.

Brands that proactively adapt to these anticipated consumer shifts will be best positioned to maintain market share and consumer loyalty.